A few key points from the 2019 Credit Score Myths and Habits Survey by CreditCardInsider.com

Misunderstandings about your credit score:

Does my income have an impact on my credit score?

It does not. Your income will not be included on credit reports. Based on the Credit CARD Act of 2009, banks are legally obligated to ask for your income. The law states banks can only lend you money if they are confident you will be able to make payments.

According to Terry Savage of the Chicago Tribune, “Of those surveyed, 61% think income plays a role in your credit score. (It doesn’t. You can have a high score on a relatively low income, as long as your payment history is stellar.)

I have a debit card, will I be able to build my credit history using the debit card, even if I select “credit” while using it?

No, debit cards work like an electronic check because payment is deducted from a savings or checking account. Selecting “credit” determines how the merchant processes the card.

Will I have an outstanding credit score if I don’t have any credit card debt?

Yes, minimizing your debts is important, but it’s just one piece of the puzzle. You need to establish a credit history with consistent, on-time payments. Also, have a diverse mix of credit such as credit cards, auto loans and/or mortgages.

How credit affects your interest rate…

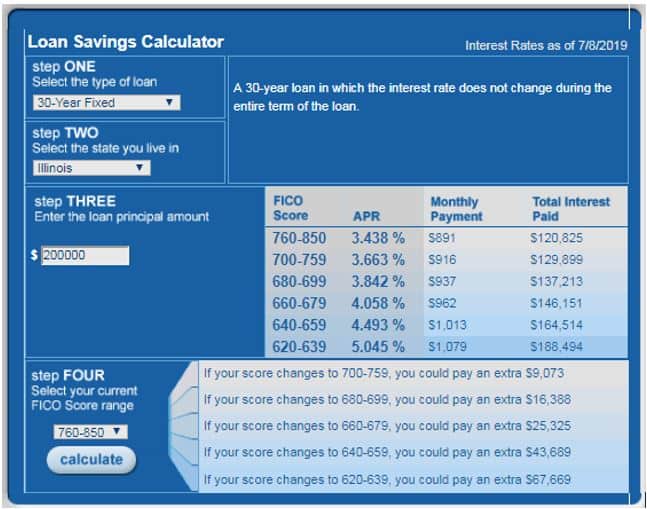

The higher the score could increase your chance of receiving a lower interest and saving thousands of dollars over the life of your loan.

“Most credit scores fall in a range of from 300 to 850. A score above 700 or higher is generally considered good, but a score over 800 is excellent. A high score will save you money on interest or finance charges.” Wrote Terry Savage – Chicago Tribune

An example based on a 30-Year Fixed Illinois loan: